What Medical Conditions Qualify for Long-term Disability

Navigating the Unexpected: A Comprehensive Guide to Long-Term Disability and Qualifying Conditions

Life can take unexpected turns. A sudden illness, injury, or chronic condition can significantly impact your ability to work and maintain financial stability. Long-term disability (LTD) insurance can be a lifesaver in such situations, providing a financial safety net when you’re unable to perform your regular job duties for an extended period.

This comprehensive guide dives deep into the world of long-term disability, exploring the medical conditions that might qualify for coverage and empowering you to navigate the process with clarity.

Demystifying Long-Term Disability: Understanding the Basics

Long-term disability insurance is a financial safety net designed to offer income replacement when a covered illness, injury, or disability prevents you from working in your own occupation for a predetermined period (typically 12 months or more). Here are some key considerations:

- Employer-Sponsored vs. Individual LTD: LTD coverage can be obtained through your employer-sponsored group plan or through an individual policy you purchase directly from an insurance company.

- Policy Definitions and Exclusions: Every LTD policy defines qualifying conditions and exclusions differently. Carefully review your policy details to understand what is and isn’t covered.

- Elimination Period: This is the waiting period between the onset of your disability and when your LTD benefits begin. Elimination periods can vary from 30 days to 18 months.

Understanding Your Policy is Crucial: The information presented here serves as a general guide. Always consult your specific policy details to determine qualifying conditions, limitations, and the application process.

A Spectrum of Conditions: Exploring Potential Qualifiers for Long-Term Disability

While specific qualifying conditions vary between policies, here’s a breakdown of some common medical conditions that might qualify for long-term disability benefits:

- Musculoskeletal Disorders: These encompass a wide range of conditions affecting muscles, bones, and joints, such as:

- Arthritis (degenerative, rheumatoid)

- Chronic back pain

- Carpal tunnel syndrome

- Fibromyalgia

- Neurological Disorders: Conditions like:

- Multiple sclerosis (MS)

- Parkinson’s disease

- Alzheimer’s disease

- Amyotrophic lateral sclerosis (ALS) (Lou Gehrig’s disease)

- Can significantly impair mobility, cognitive function, and daily living activities, potentially qualifying for LTD benefits.

- Cancer: Depending on the severity and treatment course, cancer can significantly impact one’s ability to work, making it a common qualifying condition for LTD.

- Cardiovascular Diseases: Conditions like:

- Heart disease

- Congestive heart failure

- Other cardiovascular conditions

- Can limit physical stamina and work capacity, potentially qualifying for LTD benefits.

- Mental Health Conditions: Severe cases of:

- Depression

- Anxiety disorders

- Bipolar disorder

- Post-traumatic stress disorder (PTSD)

- Can significantly affect daily functioning and work performance, potentially meeting LTD qualification criteria.

Important Note: This list is not exhaustive. Other medical conditions, depending on their severity and impact on your ability to work in your specific occupation, might also qualify for long-term disability benefits.

Consulting a Physician is Key: A crucial step in the LTD application process involves obtaining a detailed medical report from your doctor documenting your condition, limitations, and prognosis for recovery.

Beyond Diagnosis: Factors Influencing Long-Term Disability Approval

While a qualifying medical condition is essential, approval for LTD benefits often hinges on additional factors:

- Your Occupation: LTD benefits are designed to replace income lost due to an inability to perform your specific job duties. If you can transition to a less demanding role within your field, your claim might be denied.

- Severity of Your Condition: The severity of your condition and its impact on your ability to work full-time in any occupation will be assessed by the insurance company.

- Policy Definitions: The specific language used in your LTD policy regarding qualifying conditions and limitations plays a crucial role in determining approval.

Building a Strong Case for Approval: Work closely with your doctor to ensure your medical records accurately document your limitations. Consider seeking legal counsel specializing in disability insurance to navigate the application process and strengthen your claim.

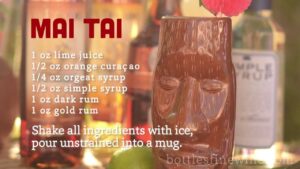

Enhancing SEO with Visuals: Including high-quality infographics or images representing the different medical condition categories (musculoskeletal, neurological, etc.) can significantly enhance user engagement and understanding.

FAQ Symphony: Addressing Your Long-Term Disability Concerns

Now that you’re armed with knowledge about qualifying medical conditions, let’s address some frequently asked questions (FAQs) regarding long-term disability:

-

Q: When should I file a claim for long-term disability?

- A: Consult your policy documents and contact your insurance provider as soon as possible after a qualifying medical event. Early notification demonstrates your intent to file a claim and allows for a smoother application process. Ideally, you should file your claim before the end of your elimination period to ensure uninterrupted income replacement.

-

Q: What documents do I need to submit with my LTD claim?

- A: Typically, you’ll need to submit a completed claim form, detailed medical reports from your doctor, and any other documentation supporting your claim, such as employment records, test results, and a letter from your employer outlining the limitations your condition imposes on your ability to perform your job duties.

-

Q: What happens after I file a claim?

- A: The insurance company will initiate an investigation to assess your claim. This might involve reviewing your medical records, contacting your doctor for clarification, and potentially arranging an independent medical examination.

-

Q: What if my LTD claim is denied?

- A: If your initial claim is denied, you have the right to appeal the decision. This process typically involves submitting additional documentation and potentially requesting a hearing with the insurance company. Consider consulting with an attorney specializing in disability insurance to navigate the appeals process.

-

Q: How long do LTD benefits typically last?

- A: The duration of LTD benefits varies depending on your policy and the severity of your condition. Some policies pay benefits until retirement age, while others have a set benefit period (e.g., 2 years, 10 years).

-

Q: Are there tax implications for LTD benefits?

- A: In some cases, LTD benefits may be considered taxable income. It’s crucial to consult with a tax advisor to understand the tax implications of receiving LTD benefits in your specific situation.

-

Q: Can I return to work while receiving LTD benefits?

- A: Some LTD policies allow for partial benefits if you return to work part-time while still experiencing limitations due to your disability. Always consult your specific policy details and the insurance company regarding any potential impact on your benefits if you attempt to return to work.

-

Q: How can I maintain good health while on long-term disability?

- A: Maintaining good health is crucial during a long-term disability. Continue following your doctor’s treatment plan, attend any necessary appointments, and prioritize healthy lifestyle habits like a balanced diet and regular exercise (as appropriate for your condition).

By understanding the qualifying conditions, application process, and potential challenges associated with long-term disability insurance, you can be better prepared to navigate an unexpected medical event and the financial implications it might bring. Remember, consulting with your doctor, an insurance professional, and potentially an attorney specializing in disability insurance can significantly enhance your understanding of your rights and strengthen your claim for long-term disability benefits.